Ireland Market Value: €5.4bn

(ROI alcoholic drinks)

2018 growth +1.0%

10k licensed premises in Ireland

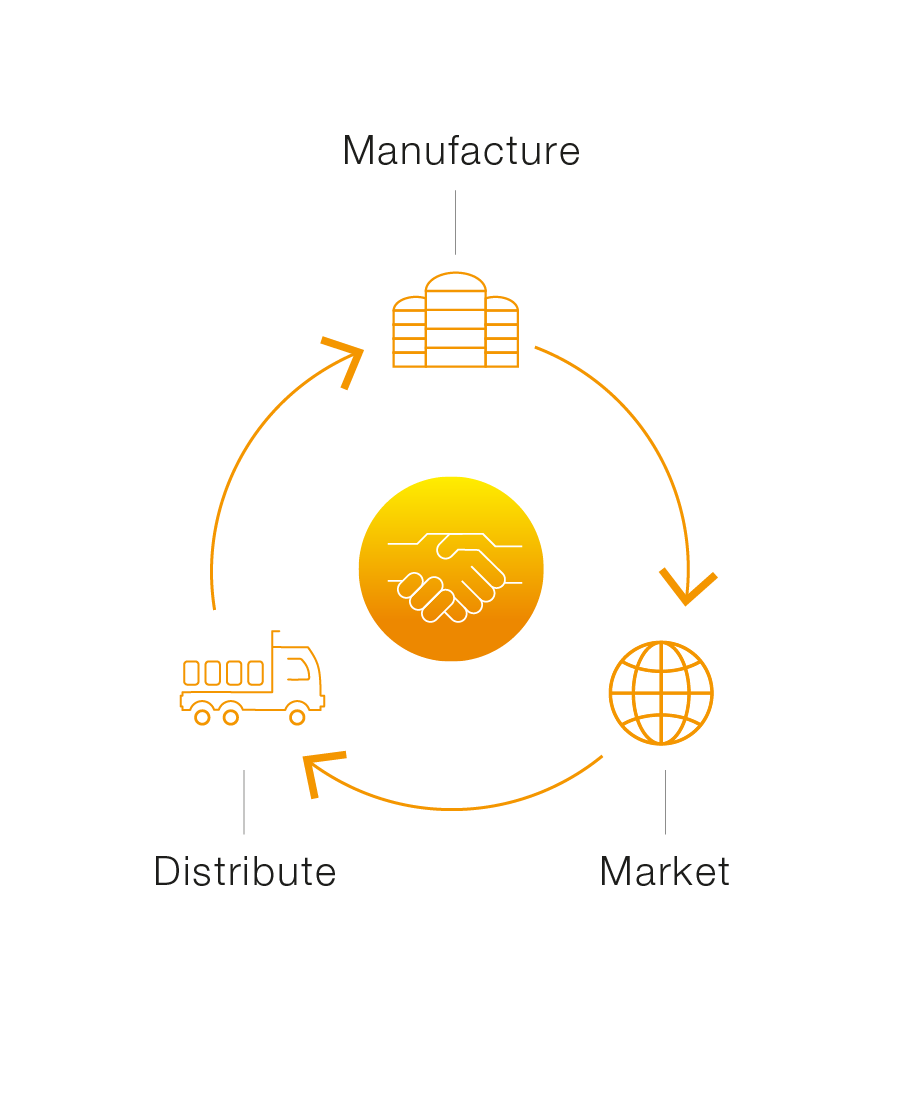

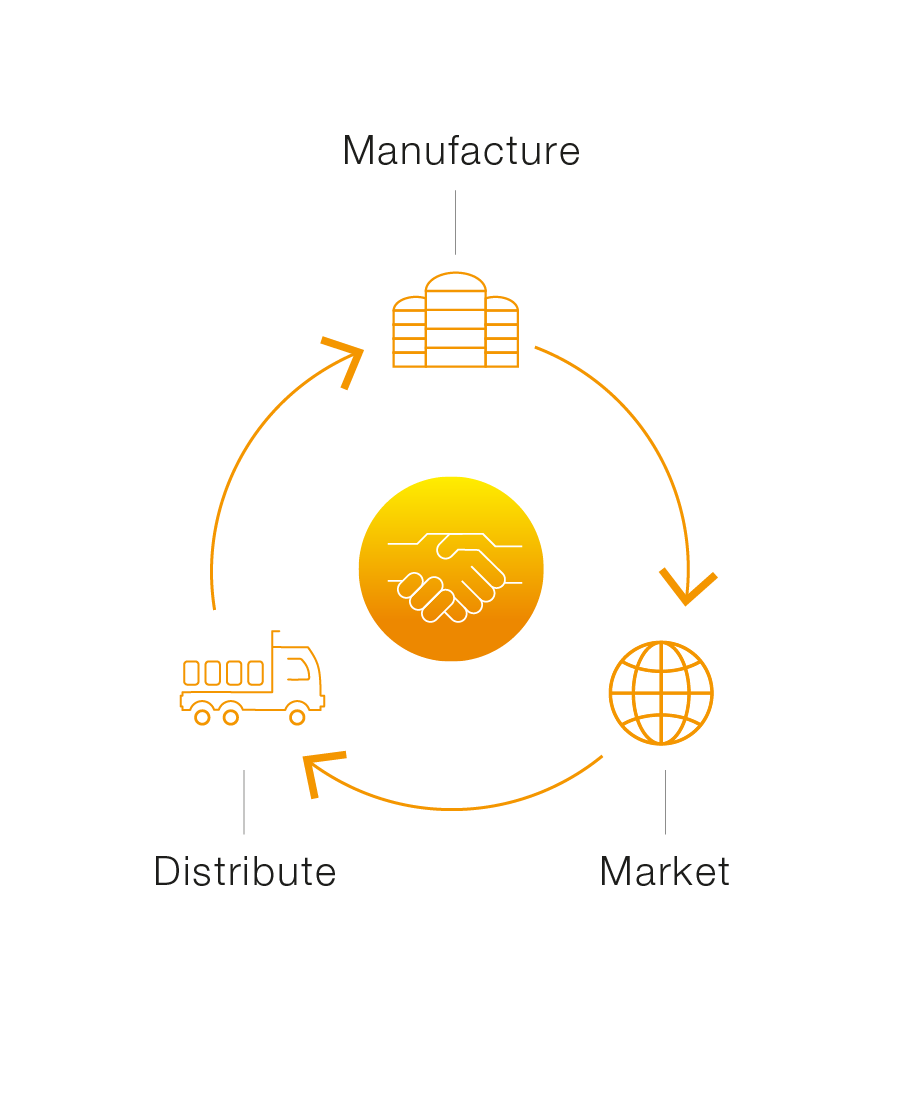

C&C Group plc is a leading, vertically integrated premium drinks company which manufactures, markets and distributes branded beer, cider, wine, spirits, and soft drinks across the UK and Ireland.

C&C Group’s portfolio of owned/exclusive brands include: Bulmers, the leading Irish cider brand; Tennent’s, the leading Scottish beer brand; Magners the premium international cider brand; as well as a range of fast-growing, super-premium and craft ciders and beers, such as Heverlee, Menabrea and Orchard Pig. C&C exports its Magners and Tennent’s brands to over 60 countries worldwide.

C&C Group has owned brand and contract manufacturing/packing operations in Co. Tipperary, Ireland; Glasgow, Scotland; and Vermont, US, where it manufactures Woodchuck, a leading craft cider brand in the United States.

C&C is the No.1 drinks distributor to the UK and Ireland hospitality sectors. Operating under the Matthew Clark, Bibendum, Tennent’s and C&C Gleeson brands, the Group supplies over 35,000 pubs, bars, restaurants and hotels, and is a key route-to-market for major international beverage companies.

C&C Group also has an investment in the Admiral Taverns tenanted pub group, which owns over 800 pubs across England & Wales.

C&C Group plc is headquartered in Dublin and is listed on the Irish and London Stock Exchanges.

Net Revenue

Increased by +188.1%1, organic net revenue growth +3.2%1

Operating Profit

before exceptional items up 21.5%1, organic operating profit growth +3.3%1

Adjusted Diluted Earnings Per Share

per share up 20.9% before exceptional items

Free Cash Flow Conversion

before exceptional items

Proposed Final Dividend

per share delivering 5.0% growth in the full year dividend to 15.31 cent per share

1.Financial highlights percentage movement versus last year are stated on a constant currency basis (FY2018 translated at FY2019 F/X rates as outlined on page 32).

In this my first year as Non-Executive Chairman, I am delighted to report on a period of significant strategic, operational and financial progress at your Company. The acquisitions of Matthew Clark and Bibendum in April 2018 transformed C&C into the largest last mile drinks distribution business across the UK and Ireland to complement our unique brand portfolio.

Download Chairman's Statement

Reported net revenue in the year of €1,575 million has increased against previous years by the acquisition in April 2018 of Matthew Clark and Bibendum. Excluding the impact of these acquisitions our net revenue on an organic basis rose 3.2% from €547 million to €564 million.

Download CEO's Review

C&C is reporting net revenue of €1,574.9 million, operating profit of €104.5 million, adjusted diluted EPS of 26.6 cent and FCF of 80.8%.

Download CFO's Review

C&C Group’s portfolio of owned/exclusive brands include: Bulmers, the leading Irish cider brand; Tennent’s, the leading Scottish beer brand; Magners the premium international cider brand; as well as a range of fast-growing, super-premium and craft ciders and beers, such as Heverlee, Menabrea and Orchard Pig.

C&C is the No.1 drinks distributor to the UK and Ireland hospitality sectors and is a key route-to-market partner for all major local and international beverage brand owners.

C&C supplies 12,000 SKUs to over 35,000 pubs, bars, restaurants and hotels across the UK and Ireland and exports its brands to over 60 countries internationally.

C&C’s Ireland division includes the sale of the Group’s own branded products across the Island of Ireland, principally Bulmers, Magners, Tennent’s, Five Lamps, Clonmel 1650, Heverlee, Dowd’s Lane, Roundstone Irish Ale, Finches and Tipperary Water.

The Group also operates the C&C Gleeson’s drinks distribution business, a leading distributor of third party drinks to the licensed on and off trade in Ireland. The Group also distributes San Miguel, Tsingtao and selected AB InBev beer brands across the Island of Ireland.

Our primary manufacturing plant is located in Clonmel, Co. Tipperary, with major distribution and administration centres in Dublin and Belfast.

The Group also operates as a separate division, the recently acquired drinks distribution businesses - Matthew Clark and Bibendum across the UK and Ireland.

C&C’s GB division includes the sale of the Group’s own branded products in Scotland, with Tennent’s, Caledonia Best, Heverlee and Magners the principal brands.

This division includes the sale of the Group’s portfolio of owned cider brands across the rest of GB, including Magners, Orchard Pig, K cider, and Blackthorn which are distributed in partnership with AB InBev. In addition, the division includes the Tennent’s drinks distribution business in Scotland. The Group also distributes selected AB InBev brands in Scotland and the Tsingtao, Pabst and Menabrea international beer brands across the UK.

Our primary manufacturing plant and administration centre is located at the Wellpark Brewery in Glasgow.

C&C’s International division manages the sale and distribution of the Group’s own branded products, principally Magners and Tennent’s outside of the UK and Ireland. The Group exports to over 60 countries globally, notably in continental Europe, Asia and Australia.

The Group operates mainly through local distributors in these markets and regions.

This division includes the sale of the Group’s cider and beer products in the US and Canada. The Vermont Hard Cider Company manufactures the Woodchuck and Wyder’s brands at its cidery in Middlebury, Vermont.

C&C Group’s portfolio of owned/exclusive brands include: Bulmers, the leading Irish cider brand; Tennent’s, the leading Scottish beer brand; Magners the premium international cider brand; as well as a range of fast-growing, super-premium and craft ciders and beers, such as Heverlee, Menabrea and Orchard Pig.

C&C is the No.1 drinks distributor to the UK and Ireland hospitality sectors and is a key route-to-market partner for all major local and international beverage brand owners.

C&C supplies 12,000 SKUs to over 35,000 pubs, bars, restaurants and hotels across the UK and Ireland and exports its brands to over 60 countries internationally.

C&C’s Ireland division includes the sale of the Group’s own branded products across the Island of Ireland, principally Bulmers, Magners, Tennent’s, Five Lamps, Clonmel 1650, Heverlee, Dowd’s Lane, Roundstone Irish Ale, Finches and Tipperary Water.

The Group also operates the C&C Gleeson’s drinks distribution business, a leading distributor of third party drinks to the licensed on and off trade in Ireland. The Group also distributes San Miguel, Tsingtao and selected AB InBev beer brands across the Island of Ireland.

Our primary manufacturing plant is located in Clonmel, Co. Tipperary, with major distribution and administration centres in Dublin and Belfast.

The Group also operates as a separate division the recently acquired drinks distribution businesses - Matthew Clark and Bibendum across the UK and Ireland.

C&C’s GB division includes the sale of the Group’s own branded products in Scotland, with Tennent’s, Caledonia Best, Heverlee and Magners the principal brands and the Group’s share of the Drygate craft brewery joint venture.

This division includes the sale of the Group’s portfolio of owned cider brands across the rest of GB, including Magners, Orchard Pig, K cider, and Blackthorn which are distributed in partnership with AB InBev. In addition, the division includes the Tennent’s drinks distribution business in Scotland. The Group also distributes selected AB InBev brands in Scotland and the Tsingtao, Pabst and Menabrea international beer brands across the UK.

Our primary manufacturing plant and administration centre is located at the Wellpark Brewery in Glasgow.

C&C’s International division manages the sale and distribution of the Group’s own branded products, principally Magners and Tennent’s outside of the UK and Ireland. The Group exports to over 60 countries globally, notably in continental Europe, Asia and Australia.

The Group operates mainly through local distributors in these markets and regions.

This division includes the sale of the Group’s cider and beer products in the US and Canada. The Vermont Hard Cider Company manufactures the Woodchuck and Wyder’s brands at its cidery in Middlebury, Vermont.

Our three core brands: Tennent’s, Bulmers and Magners hold a special place in the hearts of regional, national and global drinkers. Tennent’s is Scotland’s favourite beer, Bulmers is Ireland’s No.1 cider and Magners is the No.2 apple cider in the UK and is one of the few truly global apple cider brands.

Tennent’s Lager is brewed to the highest standards using only local Scottish ingredients to create a lager with a crisp taste and refreshingly clean finish. Tennent’s has been made with pride in the heart of Glasgow since 1885, but is famous far beyond its home city. Tennent’s Lager is Scotland’s best-selling lager.

Bulmers Original is a premium, traditional blend of 100% Irish cider with an authentic clean and refreshing taste. Only ever made with the finest Irish apples in Clonmel, Co. Tipperary.

Magners is a premium, traditional blend of Irish cider with a crisp, refreshing flavour and a natural authentic character. Also in the range is Magners Dark Fruit which offers cider drinkers a fruitier alternative to draught apple.

Our growing portfolio of super-premium and craft beers and ciders serves the consumer’s increasing demand for diversity, newness and taste. These are premium products commanding premium prices and support our core brand propositions. We are targeting that super-premium and craft will represent over 10% of branded revenue in the medium-term through a combination of in-house innovation, international agency and investment in leading craft brands.

Heverlee is a premium Belgian Beer, which is endorsed by the Abbey of the order of Prémontré, in the town of Heverlee in Leuven.

The Five Lamps Dublin Brewery was originally set up in early 2012 beside Dublin’s iconic Five Lamps. Its first beer, Five Lamps Dublin Lager, was launched in September 2012.

Menabrea is from Northern Italy and is matured gently in the perfect temperature of cave cellars for a taste of superior clarity. This pale lager is well balanced between citrus, bitter tones and floral, fruity undertones giving a consistent and refined flavour.

Orchard Pig craft ciders are full of Somerset character and scrumptious tanins found in West Country cider apples.

* Volume growth in the 12 months to 28 February 2019

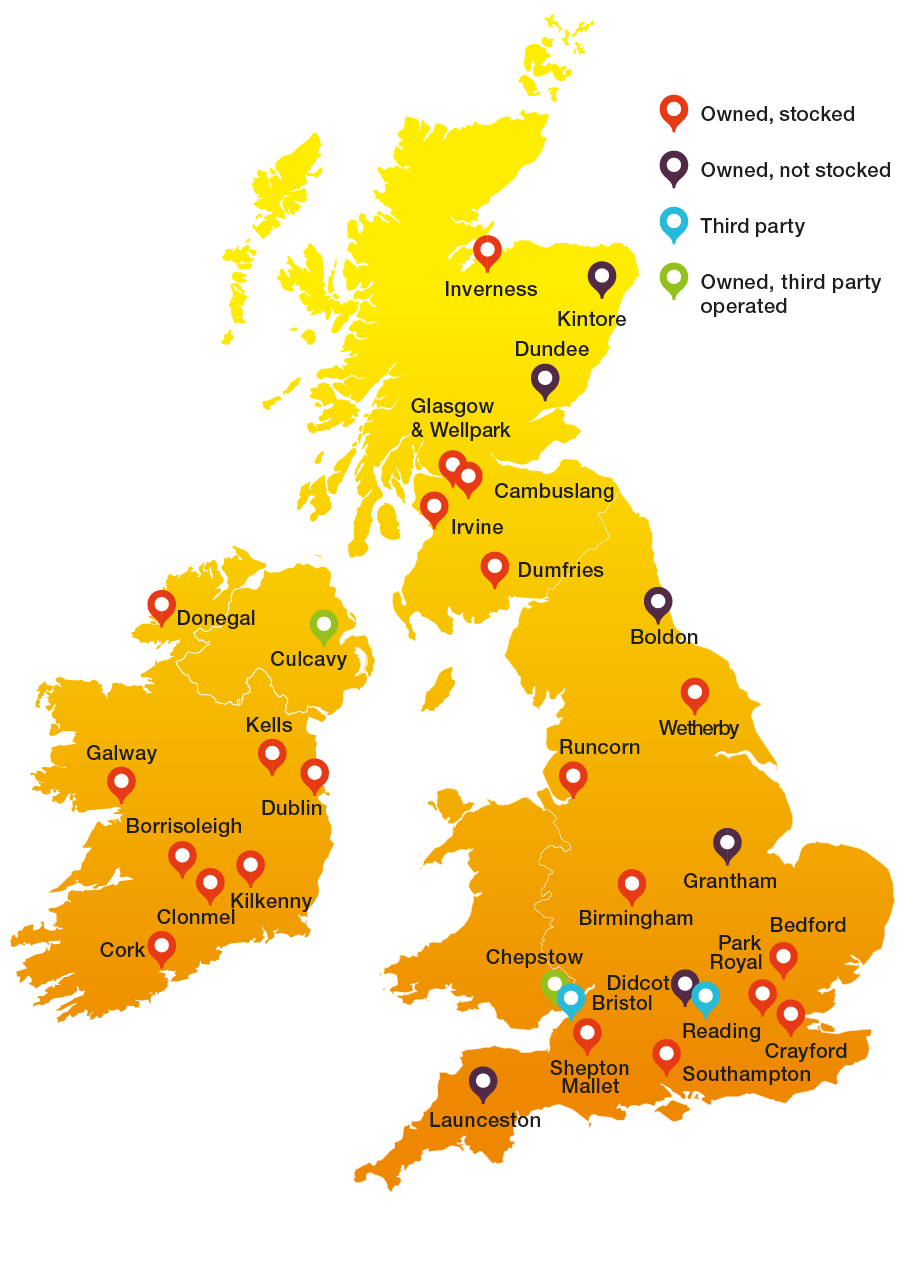

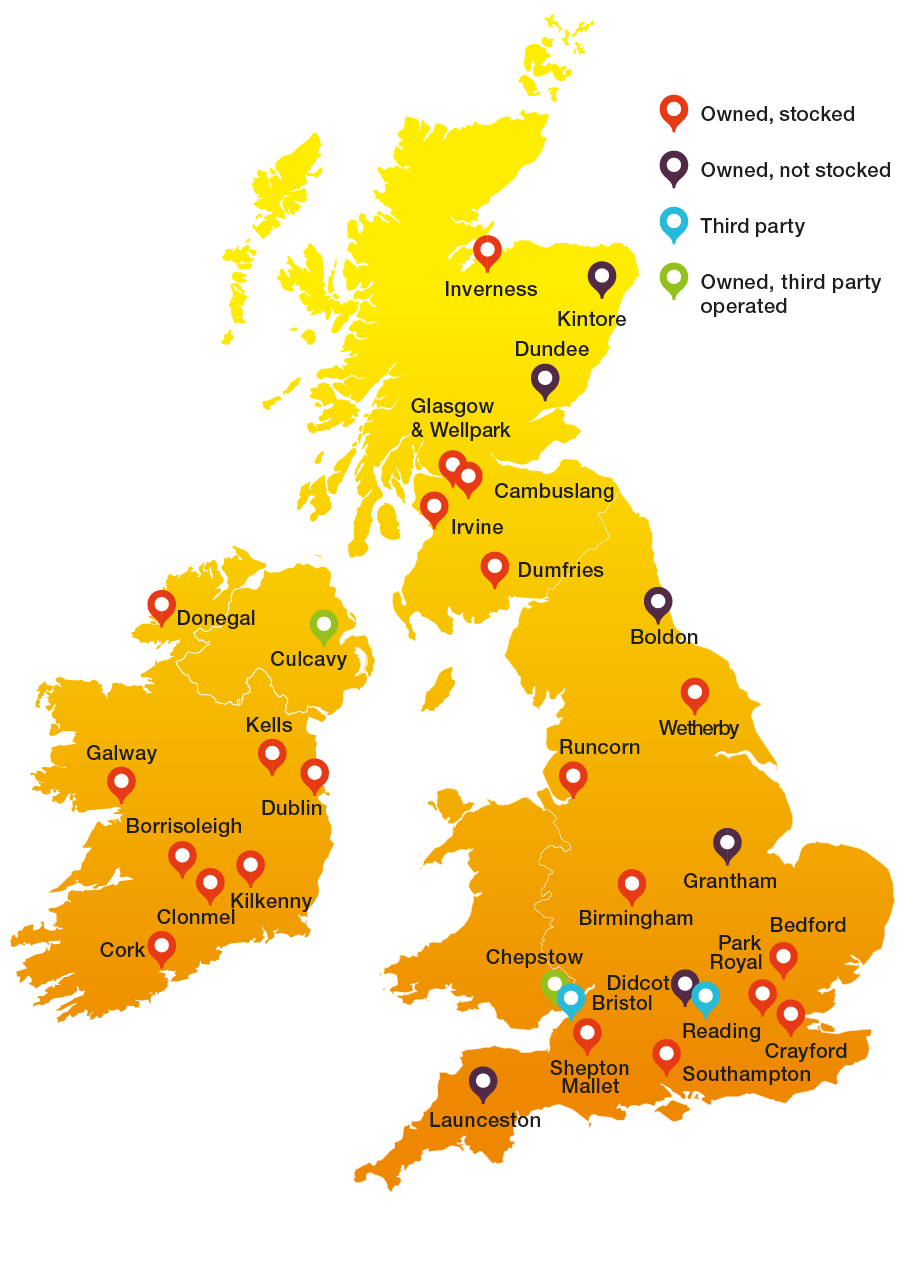

C&C’s route-to-market platforms are an integral part of the UK and Ireland hospitality sector.

C&C gives its on-trade customers access to an unrivalled portfolio of local, premium and third-party brands combined with intimate product expertise and insight into evolving consumer tastes.

With over 12,000 SKUs, C&C’s distribution platform provides a comprehensive “one stop shop” for licensed premises owners.

Our national distribution network and economies of scale provide unparalleled coverage, service and value to the benefit of our customers.

C&C’s balance sheet strength ensures stability, certainty of supply and access to credit.

Route-to-market ownership broadens C&C into a multi-beverage business.

Ensuring the Group participates in evolving consumer trends across multiple drinks categories.

C&C’s distribution platforms enhance market access and visibility for its brands.

Route-to-market complements C&C’s portfolio of local champion brands.

C&C provides a unique route-to-market platform for local and international brand owners, with unrivalled market access to over 35,000 licensed premises across the UK and Ireland.

C&C allies intimate knowledge of local and regional markets, with national coverage and economies of scale.

C&C takes over 730,000 orders per year across 12,000 SKUs generating unrivalled insight and data for brand-owners on the ever evolving consumer and customer trends.

C&C provides an open-access, stable platform to all brand-owners – large and small.

C&C has unrivalled size, scale and distribution reach across attractive on-trade drinks markets in Ireland and UK.

No.1 Drinks distributor on Island of Ireland

Ireland Market Value: €5.4bn

(ROI alcoholic drinks)

2018 growth +1.0%

10k licensed premises in Ireland

No.1 Drinks distributor in Scotland and GB

UK Market Value: £52.2bn

2018 growth +4.1%

119k licensed premises in GB

(of which 11k in Scotland)

Our ambition is to be the pre-eminent integrated brands and drinks distribution business serving the UK and Ireland hospitality industry. Our brand and distribution assets provide: an unrivalled range of ‘fabric’, premium and third-party brands; enhanced customer service; market insight, value and national coverage.

Brand and product investment to build value of key brands over the long-term.

Leverage key brand strength and market position to grow our portfolio of super-premium and craft brands.

Margin expansion at Matthew Clark and Bibendum through simplification and optimisation programmes.

Deliver unrivalled portfolio strength, value and service to the UK and Irish hospitality sectors.

Maintain medium term balance sheet leverage of circa 2.0x Net Debt/EBITDA.

Selective acquisitions to fuel sustainable, profitable growth and/or cash returns to shareholders.

FY2019 saw a strong performance across our branded portfolio in the UK and Ireland, with total C&C branded revenues +4.4%, outperforming the wider beer and cider sectors.

Our three core brands of Tennent’s, Bulmers and Magners performed well, benefitting from the warm summer and continued investment in social media, sponsorship and product innovation. Organic net sales revenues for our three core brands were up 5.5% in the UK and Ireland in the period growing our share in a number of key markets.

We saw strong organic growth in our super-premium and craft portfolio with volumes +15%. Our super-premium and craft portfolio now contributes 157kHL of volumes (7.9% of Group branded revenues) and revenues of €23.1m. We strengthen our portfolio of premium international agency brands, securing the exclusive distribution rights on Tsingtao, China’s leading beer brand, across the UK and Ireland.

In April 2018, we completed the acquisition of Matthew Clark and Bibendum, two of the UK’s largest independent drinks distribution businesses. They had been operating under severe financial and operational stress for an extended period and stock availability, customer service levels, supplier relations and financial controls were in our view significantly below the appropriate level. During FY2019 our management teams at Matthew Clark and Bibendum have made excellent progress in stabilising these businesses, with operational performance and customer service now fully restored.

Our drinks distribution and wine businesses in Scotland and Ireland also performed strongly in the year, bouyed by the enhanced scale and expertise brought to the Group by the acquisitions of Matthew Clark and Bibendum. Revenues at these businesses were up +6.9% in the year.

The Group delivered strong free cash flow of €96.9m in the year and cash conversion of 80.8% of Adjusted EBITDA (before exceptional items), assisted by an improving working capital performance at Matthew Clark and Bibendum in the second half and the inclusion of Matthew Clark and Bibendum debtor book in the C&C Group receivables purchase programme.

Consideration paid for Matthew Clark and Bibendum was a nominal sum, plus the assumption of £102 million of third-party bank debt and the on-going working capital funding requirements of the Group. As at 28 February 2019 the net cash deployment by the C&C Group in respect of these acquisitions (taking into account the working capital improvements, trading and other cashfows in the second half and the debtor securitisation programme) was £76 million.

EXISTING BUSINESSES

CAPITAL ALLOCATION

CORPORATE RESPONSIBILITY

Operating profit (before exceptional items)

FY17

€95.0m

FY18

€86.1m

FY19

€104.5m

Operating profit (before exceptional items), as a percentage of net revenue

FY17

15.9%

FY18

15.7%

FY19

6.6%

Attributable earnings before exceptional items divided by the average number of shares in issue as adjusted for the dilutive impact of equity share awards

FY17

23.8c

FY18

22.0c

FY19

26.6c

Free Cash Flow is a non GAAP measure that comprises cash flow from operating activities net of capital investment cash outflows which form part of investing activities

FY17

€54.3m

FY18

€66.0m

FY19

€91.0m

The conversion ratio is the ratio of free cash flow as a percentage of EBITDA before exceptional items

FY17

53.0%

FY18

70.5%

FY19

80.8%

The ratio of net debt (Net debt comprises borrowings (net of issue costs) less cash) to Adjusted EBITDA

FY17

1.55x

FY18

2.37x

FY19

2.51x

Total dividend per share paid and proposed in respect of the financial year in question

FY17

14.33c

FY18

14.58c

FY19

15.31c

Dividend cover is Dividend/Adjusted diluted EPS

FY17

60.2%

FY18

66.3%

FY19

57.6%

Tonnes of CO2 emissions

FY17

41,228t

FY18

31,612t

FY19

30,241t

Tonnes of waste sent to landfill

FY17

16t

FY18

0t

FY19

0t

The number of injuries that resulted in lost-work days, per 100,000 hours working time in production facilities

FY17

0.56

FY18

0.54

FY19

1.02

Our three core brands: Tennent’s, Bulmers and Magners hold a special place in the hearts of regional, national and global drinkers. Tennent’s is Scotland’s favourite beer, Bulmers is Ireland’s No.1 cider and Magners is the No.2 apple cider in the UK and is one of the few truly global apple cider brands.

Tennent’s Lager is brewed to the highest standards using only local Scottish ingredients to create a lager with a crisp taste and refreshingly clean finish. Tennent’s has been made with pride in the heart of Glasgow since 1885, but is famous far beyond its home city. Tennent’s Lager is Scotland’s best-selling lager.

Bulmers Original is a premium, traditional blend of 100% Irish cider with an authentic clean and refreshing taste. Only ever made with the finest Irish apples in Clonmel, Co. Tipperary.

Magners is a premium, traditional blend of Irish cider with a crisp, refreshing flavour and a natural authentic character. Also in the range is Magners Dark Fruit which offers cider drinkers a fruitier alternative to draught apple.

Our growing portfolio of super-premium and craft beers and ciders serves the consumer’s increasing demand for diversity, newness and taste. These are premium products commanding premium prices and support our core brand propositions. We are targeting that super-premium and craft will represent over 10% of branded revenue in the medium-term through a combination of in-house innovation, international agency and investment in leading craft brands.

Heverlee is a premium Belgian Beer, which is endorsed by the Abbey of the order of Prémontré, in the town of Heverlee in Leuven.

The Five Lamps Dublin Brewery was originally set up in early 2012 beside Dublin’s iconic Five Lamps. Its first beer, Five Lamps Dublin Lager, was launched in September 2012.

Menabrea is from Northern Italy and is matured gently in the perfect temperature of cave cellars for a taste of superior clarity. This pale lager is well balanced between citrus, bitter tones and floral, fruity undertones giving a consistent and refined flavour.

Orchard Pig craft ciders are full of Somerset character and scrumptious tanins found in West Country cider apples.

* Volume growth in the 12 months to 28 February 2019

C&C’s route-to-market platforms are an integral part of the UK and Ireland hospitality sector.

C&C gives its on-trade customers access to an unrivalled portfolio of local, premium and third-party brands combined with intimate product expertise and insight into evolving consumer tastes.

With over 12,000 SKUs, C&C’s distribution platform provides a comprehensive “one stop shop” for licensed premises owners.

Our national distribution network and economies of scale provide unparalleled coverage, service and value to the benefit of our customers.

C&C’s balance sheet strength ensures stability, certainty of supply and access to credit.

Route-to-market ownership broadens C&C into a multi-beverage business.

Ensuring the Group participates in evolving consumer trends across multiple drinks categories.

C&C’s distribution platforms enhance market access and visibility for its brands.

Route-to-market complements C&C’s portfolio of local champion brands.

C&C provides a unique route-to-market platform for local and international brand owners, with unrivalled market access to over 35,000 licensed premises across the UK and Ireland.

C&C allies intimate knowledge of local and regional markets, with national coverage and economies of scale.

C&C takes over 730,000 orders per year across 12,000 SKUs generating unrivalled insight and data for brand-owners on the ever evolving consumer and customer trends.

C&C provides an open-access, stable platform to all brand-owners – large and small.

C&C has unrivalled size, scale and distribution reach across attractive on-trade drinks markets in Ireland and UK.

No.1 Drinks distributor on Island of Ireland

Ireland Market Value: €5.4bn

(ROI alcoholic drinks)

2018 growth +1.0%

10k licensed premises in Ireland

No.1 Drinks distributor in Scotland and GB

UK Market Value: £52.2bn

2018 growth +4.1%

119k licensed premises in GB

(of which 11k in Scotland)

Our ambition is to be the pre-eminent integrated brands and drinks distribution business serving the UK and Ireland hospitality industry. Our brand and distribution assets provide: an unrivalled range of ‘fabric’, premium and third-party brands; enhanced customer service; market insight, value and national coverage.

Brand and product investment to build value of key brands over the long-term.

Leverage key brand strength and market position to grow our portfolio of super-premium and craft brands.

Margin expansion at Matthew Clark and Bibendum through simplification and optimisation programmes.

Deliver unrivalled portfolio strength, value and service to the UK and Irish hospitality sectors.

Maintain medium term balance sheet leverage of circa 2.0x Net Debt/EBITDA.

Selective acquisitions to fuel sustainable, profitable growth and/or cash returns to shareholders.

FY2019 saw a strong performance across our branded portfolio in the UK and Ireland, with total C&C branded revenues +4.4%, outperforming the wider beer and cider sectors.

Our three core brands of Tennent’s, Bulmers and Magners performed well, benefitting from the warm summer and continued investment in social media, sponsorship and product innovation. Organic net sales revenues for our three core brands were up 5.5% in the UK and Ireland in the period growing our share in a number of key markets.

We saw strong organic growth in our super-premium and craft portfolio with volumes +15%. Our super-premium and craft portfolio now contributes 157kHL of volumes (7.9% of Group branded revenues) and revenues of €23.1m. We strengthen our portfolio of premium international agency brands, securing the exclusive distribution rights on Tsingtao, China’s leading beer brand, across the UK and Ireland.

In April 2018, we completed the acquisition of Matthew Clark and Bibendum, two of the UK’s largest independent drinks distribution businesses. They had been operating under severe financial and operational stress for an extended period and stock availability, customer service levels, supplier relations and financial controls were in our view significantly below the appropriate level. During FY2019 our management teams at Matthew Clark and Bibendum have made excellent progress in stabilising these businesses, with operational performance and customer service now fully restored.

Our drinks distribution and wine businesses in Scotland and Ireland also performed strongly in the year, bouyed by the enhanced scale and expertise brought to the Group by the acquisitions of Matthew Clark and Bibendum. Revenues at these businesses were up +6.9% in the year.

The Group delivered strong free cash flow of €96.9m in the year and cash conversion of 80.8% of Adjusted EBITDA (before exceptional items), assisted by an improving working capital performance at Matthew Clark and Bibendum in the second half and the inclusion of Matthew Clark and Bibendum debtor book in the C&C Group receivables purchase programme.

Consideration paid for Matthew Clark and Bibendum was a nominal sum, plus the assumption of £102 million of third-party bank debt and the on-going working capital funding requirements of the Group. As at 28 February 2019 the net cash deployment by the C&C Group in respect of these acquisitions (taking into account the working capital improvements, trading and other cashfows in the second half and the debtor securitisation programme) was £76 million.

EXISTING BUSINESSES

CAPITAL ALLOCATION

CORPORATE RESPONSIBILITY

FY17

€95.0m

FY18

€86.1m

FY19

€104.5m

FY17

15.9%

FY18

15.7%

FY19

6.6%

FY17

23.8c

FY18

22.0c

FY19

26.6c

FY17

€54.3m

FY18

€66.0m

FY19

€91.0m

FY17

53.0%

FY18

70.5%

FY19

80.8%

FY17

1.55x

FY18

2.37x

FY19

2.51x

FY17

14.33c

FY18

14.58c

FY19

15.31c

FY17

60.2%

FY18

66.3%

FY19

57.6%

FY17

41,228t

FY18

31,612t

FY19

30,241t

FY17

16t

FY18

0t

FY19

0t

FY17

0.56

FY18

0.54

FY19

1.02